If you’re in college, building credit early is one of the smartest financial moves you can make.

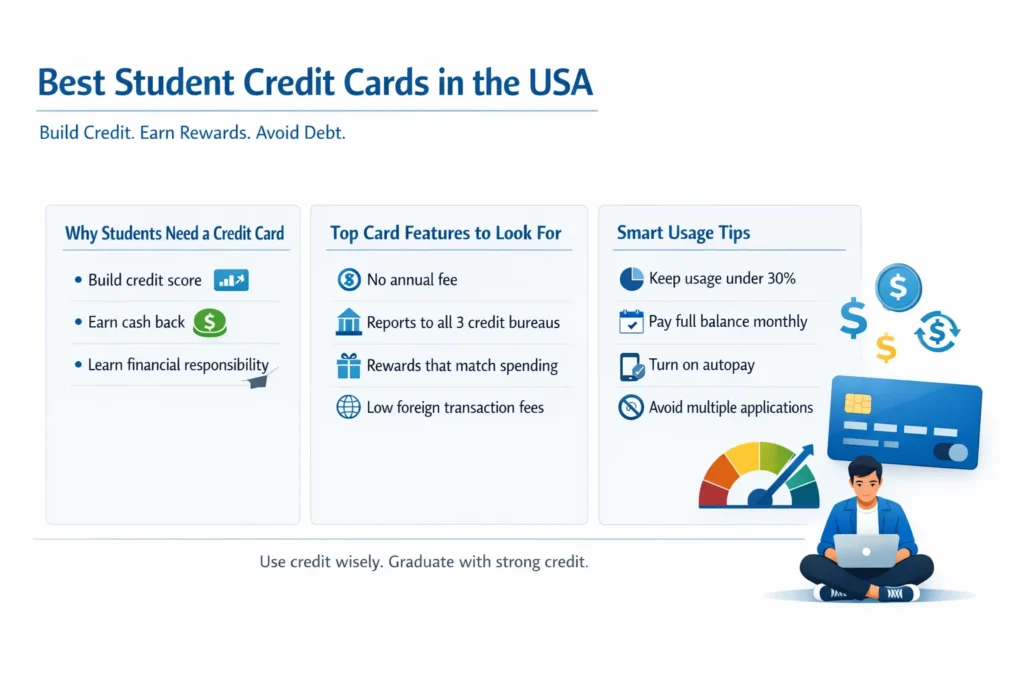

A student credit card helps you:

- Build your credit score

- Earn rewards on everyday spending

- Learn how borrowing works

- Qualify for better loans after graduation

But here’s the truth: a credit card can either help you build wealth or quietly trap you in debt.

Why Students Should Get a Credit Card If Used Correctly

Your credit score affects:

- Renting an apartment

- Getting a car loan

- Mortgage approval

- Insurance rates

- Even some job applications

Starting at 18 to 22 years old gives you a major head start.

The key factors that build credit:

- Payment history (35%) – Always pay on time.

- Credit utilization (30%) – Keep usage under 30% of your limit.

- Length of credit history (15%) – The earlier you start, the better.

A student card is designed for beginners with easier approval, lower limits, and simple rewards.

Best Student Credit Cards in the USA

These are consistently top choices for students because of:

- No annual fee

- Good approval odds

- Strong rewards

- Solid credit building benefits

1)Discover it Student Cash Back

Best overall student credit card

Why students choose it:

- 5% cash back in rotating categories like gas, Amazon, and groceries

- 1% on all other purchases

- Cashback Match at the end of the first year

- No annual fee

- Free credit score monitoring

Best for students who do not mind activating quarterly categories.

Note: Discover cards are not as widely accepted internationally as Visa or Mastercard. They also may charge foreign transaction fees, so check terms carefully if you plan to study abroad.

2)Capital One Quicksilver Student Cash Rewards

Best flat rate rewards card

- Unlimited 1.5% cash back on everything

- No categories to track

- No annual fee

- Credit building tools included

Best for students who want simple, predictable rewards.

Note: This card may charge foreign transaction fees depending on the version. Always verify before using it internationally.

3)Capital One Savor Student

Best for dining and entertainment

- Higher rewards on dining and entertainment

- Good for students who eat out or use streaming services

- No annual fee

Best for students who spend more on food and experiences.

Check foreign transaction fees if you plan to use it outside the United States.

4)Bank of America Travel Rewards for Students

Best for travel and study abroad

- Earn points toward travel

- No foreign transaction fees

- No annual fee

Best for students studying abroad or traveling frequently.

Important: Not all student credit cards waive foreign transaction fees. Some charge around 3% on international purchases. If you plan to travel or study abroad, confirm this detail before applying.

5)Discover it Secured Card

Best option if you have no credit history

- Requires refundable security deposit

- Earns rewards

- Reports to all major credit bureaus

Best for students with no credit history or previous rejection.

6) Chase Freedom Rise

Best for beginners building credit with Chase

- Unlimited 1.5% cash back on all purchases

- No annual fee

- Designed for people new to credit

- Strong upgrade potential to other Chase Freedom cards

Best for students who want to build a long-term relationship with Chase and upgrade later.

7) Bank of America Customized Cash Rewards for Students

Best for flexible cash back categories

- 3% cash back in a category of your choice

- 2% at grocery stores and wholesale clubs

- 1% on all other purchases

- No annual fee

Best for students who want control over where they earn the most rewards.

8)Citi Rewards+ Student Option

Best for small everyday purchases

- Automatically rounds up points to the nearest 10

- 2X points at supermarkets and gas stations

- No annual fee

Best for students who frequently make small purchases like coffee, snacks, and campus expenses.

9)Petal 2 Visa Credit Card

Best for limited or no credit history

- No annual fee

- Cash back rewards after on-time payments

- Uses alternative approval criteria beyond traditional credit score

Best for students with thin credit files or limited income history.

10)Deserve EDU Mastercard

Best for international students without SSN

- No SSN required

- No foreign transaction fees

- Designed specifically for international students

Best for students studying in the United States who may not qualify for traditional cards.

Best Options for International Students

If you do not have an SSN:

- Some cards accept an ITIN

- Some banks allow passport and student visa documentation

Common options include:

- Discover student cards that accept ITIN

- Capital One student cards

Always confirm eligibility requirements before applying.

What to Look for in a Student Credit Card

Before applying, check:

- No annual fee

- Reasonable APR

- Reports to Experian, Equifax, and TransUnion

- Rewards that match your spending habits

- Upgrade path to a regular card later

- Foreign transaction fee policy if you plan to travel

If it does not report to all three credit bureaus, it will not help you build credit properly.

Common Mistakes Students Make

Avoid these:

- Paying only the minimum balance

- Maxing out the card

- Missing even one payment

- Applying for too many cards at once

Even one late payment can significantly lower your credit score.

Smart Strategy for Using a Student Credit Card

Follow this simple method:

- Use the card for one expense category such as gas or groceries.

- Keep spending under 30% of your limit.

- Turn on autopay for the full balance.

- Never treat it like extra income.

If you do not already have the money in your bank account, do not use the card.

How Much Credit Score Can You Build

If used correctly:

- After 6 months you can begin generating a credit score.

- After 12 months you may reach the 680 to 720 range.

- After 2 to 3 years you can graduate with strong credit history.

Results vary depending on payment history and overall credit behavior.

What If You Get Denied

Do not panic.

You can:

- Apply for a secured credit card

- Become an authorized user on a parent’s card

- Try again after 6 months

- Review your credit report for errors

If you become an authorized user, make sure the primary cardholder has a strong payment history and low credit utilization. Their late payments or high balances can negatively affect your credit score as well.

A rejection is not permanent.

Should Students Get a Credit Card

Yes if you:

- Have stable income, including part time work

- Can control spending

- Want to build credit early

No if you:

- Struggle with impulse spending

- Already have debt issues

- Do not understand how credit card interest works

Final Advice for Students

Credit cards are financial tools.

Used responsibly, they build your financial future.

Used carelessly, they create debt and stress.

Start small.

Pay in full.

Stay consistent.

If you graduate with a credit score above 700, you will already be ahead financially compared to many peers.